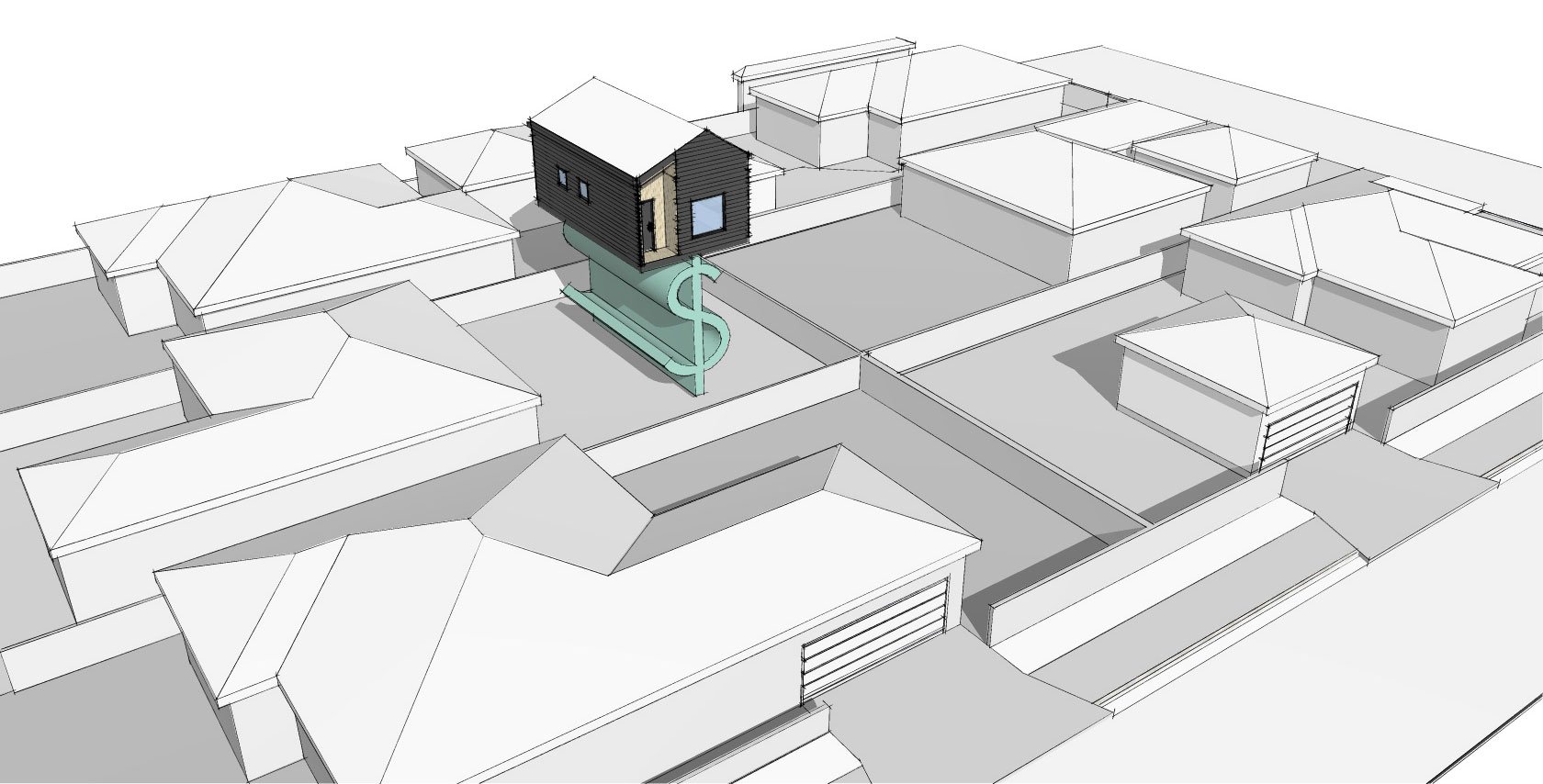

If you don’t have the cash to build an ADU or you don’t have enough equity in your home to do a Home Equity Line of Credit, a Renovation Loan might be the best way to finance your ADU.

A Home Equity Line of Credit “HELOC” has limitations. If your home is currently worth $500,000 and you owe $350,000 on your current mortgage. Most banks will lend up to 80% of the current value, or $400,000. This leaves only $50,000 available to build the ADU.

A great alternative to this is a renovation loan. Renovation loan appraisals are based on the “As-Completed” value of the home. So if the home will be worth $550,000 once the ADU is complete, the renovation loan will lend up to 95% of the “As-Completed” value, or $522,500. This gives you $172,500 available to build the ADU.

Knowing the high price of real estate in Los Angeles, this opens up a lot of opportunities to finance much or all of the cost of your backyard home.

Contact us to learn more about our financing partners offering these loans for ADUs.